London nickel has fluctuated sharply after the resumption of trading, and it is not yet fully determined when the nickel market will return to its fundamentals. There are sporadic transactions in the domestic spot market, but the pricing of international trade is chaotic, the overall market is still stagnant, and it may take some time for the nickel market to completely calm down. From the perspective of hedging, if the company has spot inventory, it is still a good time to sell the hedging. However, it is necessary for the company to manage and control risks as much as possible to avoid losses due to liquidity problems due to large price fluctuations.

Stainless steel will continue to be affected by fluctuations in nickel prices, but from the current point of view, stainless steel continues to go out of storage, and the cost support still exists. The market outlook may have limited room for decline. The negative factors are mainly due to the impact of the domestic epidemic on the demand side and the potential decline in the raw material side. space.

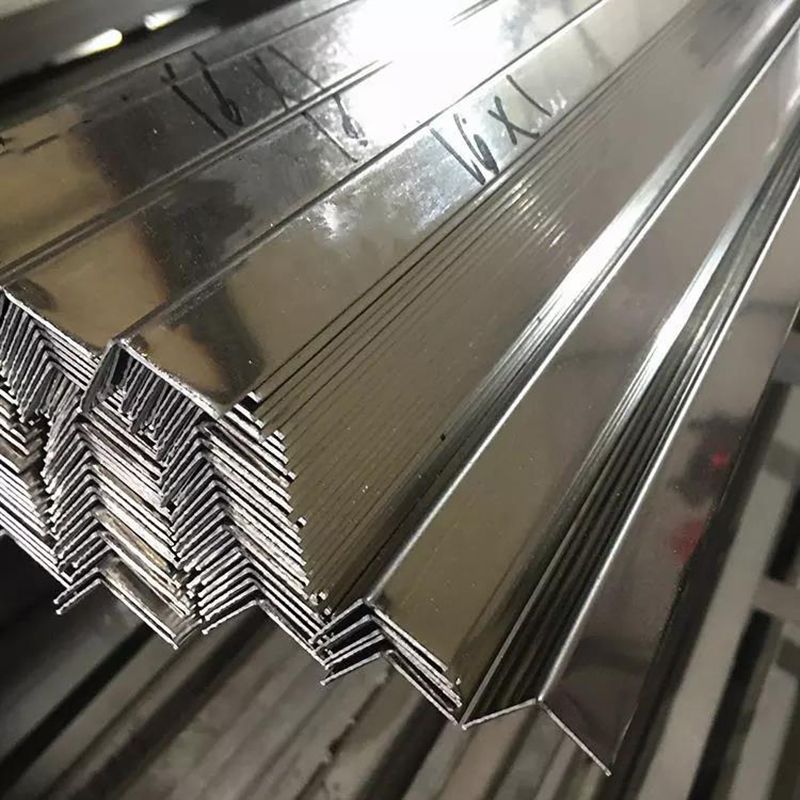

Nickel prices rose sharply in the early stage and are still fluctuating, and the cost of stainless steel has moved up.

As the price of nickel rose sharply in the early stage and was still fluctuating, the price difference of nickel pig iron remained stable for the time being after the price increase, and the cost of stainless steel increased. Spot volatility is also very drastic and still needs to be repaired by demand. Overseas production has been cut due to energy issues, and the United States has conducted the first bilateral sunset review investigation on Chinese stainless steel coils. The supply of domestic stainless steel is expected to increase in March, partly due to the impact of raw materials due to transportation reasons, which may lead to a reduction in stainless steel production. Focus on the 20000 support recently, and the failure may further weaken.

Post time: Mar-28-2022